Funding and Liquidity

In 2021 Arion Bank continued to diversify its funding options, issuing green bonds in euros and Icelandic krónur, while also becoming the first Icelandic bank to issue covered bonds in euros. The Bank pursues prudent funding and liquidity management strategies which is reflected in the Bank’s strong liquidity ratios and steady maturities of long-term debt in the medium term.

International bond issues

In September 2021 Arion Bank became the first Icelandic financial institution to issue covered bonds in euros, issuing €300 million. The bonds were sold at rates corresponding to a 0.27% margin over interbank rates, which are the best rates which an Icelandic issuer, including the Icelandic government, has obtained on the international credit markets since Arion Bank was founded 13 years ago. The issue was oversubscribed, attracting offers for €700 million from more than 30 investors in 12 countries. The bonds were sold exclusively to asset management companies, public entities and banks. Deutsche Bank AG, Barclays Bank Ireland PLC and UBS Europe SE managed the issue.

In July 2021 Arion Bank held its inaugural green bond issue in euros. The green bonds were 4-year instruments totalling €300 million. The issue was oversubscribed, attracting offers from more than 70 investors for more than €600 million.

The bonds were sold at rates corresponding to a 0.80% margin over interbank rates. Deutsche Bank AG, Barclays Bank Ireland PLC, ABN Amro Bank N.V. and Citigroup Global Markets Europe managed the issue.

The bonds were issued under the Bank’s Green Financing Framework. The Framework sets out clearly and transparently the conditions which the Bank’s loans need to meet in order to be considered green.

Domestic issuance

In December 2021 Arion Bank held its inaugural green bond in Icelandic krónur. The new series ARION 26 1222 GB attracted a positive response and bonds amounting to ISK 3,640 million were sold to a broad group of Icelandic investors. The bonds are 5-year instruments and pay fixed interest of 4.70% annually. Principal is repaid in a single payment at maturity in 2026. The bonds were issued under the Bank’s Green Financing Framework.

Arion Bank continued to issue covered bonds which are secured in accordance with the Covered Bond Act No. 11/2008. In 2021 the Bank issued covered bonds amounting to ISK 19.7 billion, of which ISK 18 billion was for its own use.

Arion Bank renewed its agreement with Kvika, Íslandsbanki and Landsbankinn on market making for covered bonds issued by Arion Bank on Nasdaq Iceland. The purpose of the agreement is to stimulate trading with benchmark covered bonds issued by the Bank.

Maturity profile

Combination of total funding

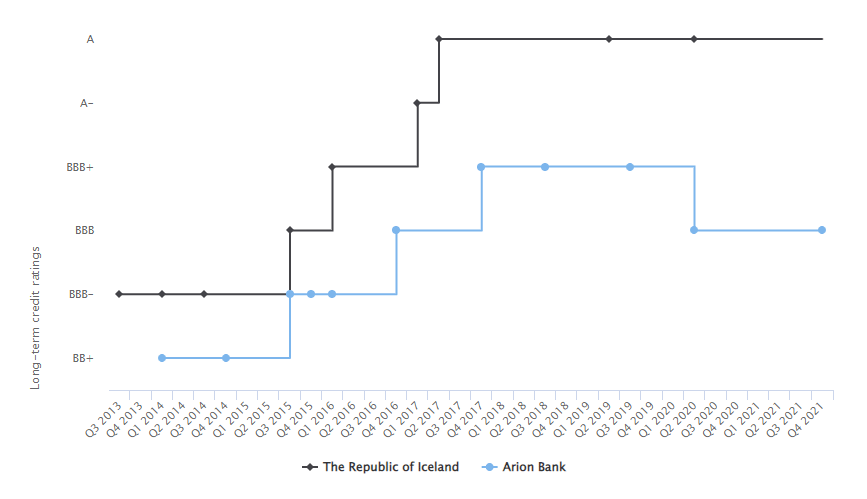

Credit rating

S&P Global Ratings affirmed Arion Bank’s BBB rating and the outlook remains stable. The Bank’s short-term rating is A-2.

S&P believes that Arion Bank will remain with a high level of capitalization and strong leverage ratios. Earnings will be supported by increasing cost efficiencies, management of funding costs, strong lending growth on the back of increased demand for mortgages, and solid corporate and investment banking and capital market activity levels.

The stable outlook indicates that while S&P sees Arion Bank as well placed to benefit from a gradual economic recovery in Iceland over the next two years, residual risks relating to the pandemic and the withdrawal of fiscal and monetary policy remain.

S&P sees the key risk to be relatively high exposure to tourism and commercial real estate. The tough operating environment and strong competition weighs against profitability prospects. It is S&P’s assessment that Arion Bank's portfolio lacks geographic diversification, given its presence in a concentrated market, and it is inherently exposed to the domestic volatile economy.

S&P Global Ratings

| Category | Arion Bank | The Republic of Iceland* |

|---|---|---|

| Long term | BBB | A |

| Short term | A-2 | A-1 |

| Outlook |

Stable | Stable |

| Last rating action |

18 October 2021 | 15 May 2020 |

*Foreign currency obligations. Please visit www.cb.is for further information.

Credit rating - timeline

Liquidity and liquidity risk

Arion Bank is largely funded with deposits from individuals, corporations and pension funds. One of Arion Bank's key objectives is to maintain a strong liquidity coverage ratio (LCR) to support the Bank’s strategic direction. The LCR, which is calculated according to rules issued by the Central Bank of Iceland and Basel III Standard addresses risk factors relating to the stickiness of deposits and the maturity mismatch of the assets and liabilities. At the end of 2021 the Bank's LCR was 203% and the ratio for foreign currencies was 607%, well above the minimum requirement stipulated by the Central Bank of Iceland.

The Bank’s net stable funding ratio, NSFR, was 121% at the end of 2021 and 212% in foreign currency. This ratio measures the proportion of Bank’s available stable funding to necessary stable funding according to a method which takes into account the liquidity of assets and the maturity of liabilities. These high ratios underline the Bank’s robust funding and its ability to support the Bank’s lending activities in the future.