Responsible banking

Arion Bank places great importance on environmental and social issues and good corporate governance (ESG) in its operations. How banks manage their financial resources can have a decisive impact on the progress of sustainable development in individual countries and globally, because a bank’s greatest impact is in the loans and investments it makes on behalf of its customers.

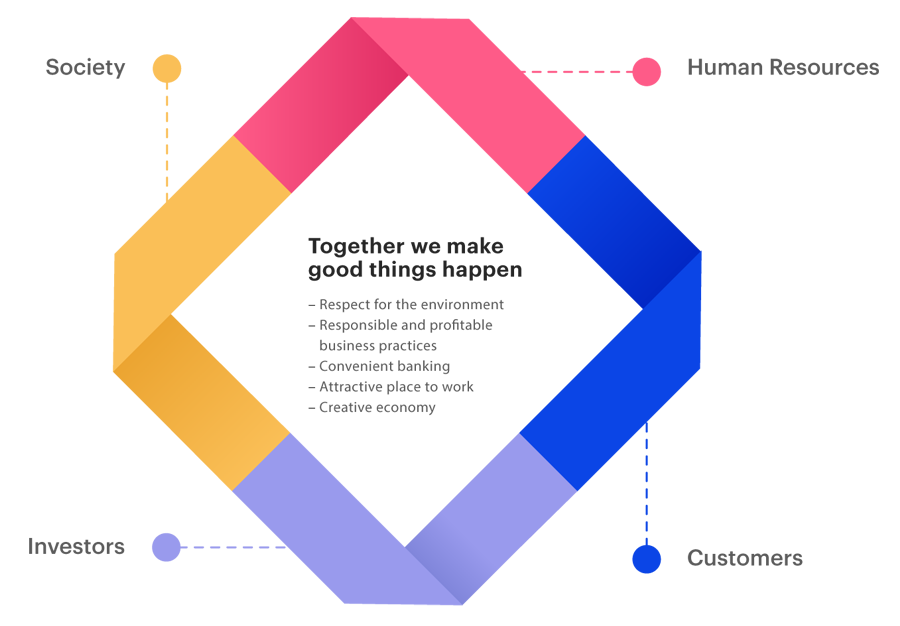

Arion Bank’s core strategy is to excel by offering smart and reliable financial solutions which create future value for our customers, shareholders and society as a whole. Arion Bank’s sustainability policy bears the title Together we make good things happen and signifies that the Bank wants to act as a role model in responsible and profitable business practices, taking into account the environment and society. At Arion Bank we aim to ensure that social responsibility and sustainability are part of the Bank's day-to-day activities, its decision-making and processes.

We refer to Arion Bank’s values as cornerstones and they are designed to provide guidance when making decisions and in everything the employees do. The cornerstones address our role, mentality and conduct and they are: we make a difference, we get things done, we say what we mean, and we find solutions. The Bank’s code of conduct has been approved by the Board of Directors and is designed to support responsible decision making.

Sustainability policy

We want to act as a role model by promoting responsible and profitable business practices, which take into account the environment, the economy and the society in which we live and work. We try to see things from our customers’ viewpoint and strive to do better today than we did yesterday.

We work in an attractive workplace where knowledge creates future value for the benefit of our customers, investors and society as a whole.

The diagram below shows our main focuses in sustainability.

Reporting on sustainability and non-financial information

Information in the annual and sustainability report has been prepared and published in accordance with the Global Reporting Initiative standard, GRI Core, which helps companies and institutions share information on sustainability in a transparent and comparable way.

When sharing information on non-financial factors of the business, the ESG reporting guide for the Nasdaq Nordic exchange and the 10 Principles of the UN Global Compact are also used a reference. We also consult the UN Sustainable Development Goals. For the second time we are reporting on the progress made in implementing the UN Principles for Responsible Banking to which Arion Bank became a signatory in September 2019.

Deloitte has provided an opinion with limited assurance on non-financial reporting in Arion Bank’s 2021 Annual and Sustainability Report which is presented in accordance with the Global Reporting Initiative (GRI Core) and the Nasdaq ESG Reporting Guide.

Arion Bank achieved outstanding score in Reitun’s ESG rating

In 2021 Arion Bank achieved an outstanding score for the second time in Reitun’s ESG rating, scoring 90 out of 100 possible points and placing it in category A3. Arion Bank ranks well above the average in all categories compared with those domestic issuers rated by Reitun (approximately 34 in total). The market average is currently 67 points, category B3. One other organization received the same number of points at the Bank, with 90 points being the highest ESG score ever awarded by Reitun. The Bank is placed in category A3 with two other organizations.

Further information on the results of the Reitun ESG rating can be found here.

UN Sustainable Development Goals

Arion Bank has selected six UN Sustainable Development Goals which the Bank intends to focus on. These goals are number 5 on gender equality; number 7 on affordable and clean energy; number 8 on decent work and economic growth; number 9 on industry, innovation and infrastructure; number 12 on responsible consumption and production; and number 13 on climate action.

The Bank’s operations, including action on gender equality, our policy and actions on environment and climate issues, support for innovation and the business sector as a whole, state-of-the-art digital services and active participation in the development of the economy closely align with these sustainable development goals.

.jpg)

Governance, sustainability and risk management

In 2021 a sustainability committee was set up and the management of sustainability risk in connection with ESG factors was defined as part of the Bank’s risk management system. The new committee replaced a sustainability steering committee which had been functioning at the Bank for many years. The CEO is the chairman of the sustainability committee, whose role is to monitor the Bank’s performance in connection with its policy and commitment on sustainability and to ensure that ESG factors are considered in decisions and plans made by the Bank. A green financing committee and equality committee are sub-committees of this committee.

In addition to the CEO, the sustainability committee includes the managing directors of Retail Banking, Corporate & Investment Banking, Markets, Customer Experience and Finance. The Chief Risk Officer and Sustainability Officer attend meetings but do not have the right to vote. The Bank’s new risk policy on sustainability was approved by the board of directors during the year and will be reviewed annually. According to the policy the Bank seeks to ensure that its operations and services do not have a negative impact on people or the environment. It also states that the Bank supports Iceland’s climate action plan, whose goal is to meet the obligations of the Paris Climate Agreement and to achieve the ambitious goal of carbon neutrality by 2040.

At the beginning of 2022 a special risk assessment was performed in connection with ESG factors at the Bank. The main social risks relate to employee equality and diversity, disclosure and relations with stakeholders. The main environmental risks were insufficient action in environmental and climate issues in connection with goods and services, employees’ compliance with the Bank’s environment and climate policy, and the risk of greenwashing. The assessment also revealed that the main governance risks were anti-money laundering measures and know-your-customer, data protection and ESG reporting. The management of these risk at the Bank was rated as adequate or strong.

The Bank has introduced a policy on actions against financial crime, such as money laundering, terrorist financing, bribery and corruption or market abuse. On the basis of this policy the Bank places great importance on knowing all customers and understanding their business so that the Bank is able to identify any suspicious transactions. Further information on governance and risk management in relation to ESG and actions against financial crime can be found in the Bank’s 2021 Pillar 3 Risk Disclosures.

Responsible banking in the time of a pandemic

Arion Bank performed well overall during the year despite the continuing challenges presented by the Covid-19 pandemic. The Bank did its utmost to provide excellent services but at the same time behaved responsibly with respect to the applicable public health measures and sought to come up with solutions with its customers to tackle the financial impact of the pandemic.

The number of visits to our branches broadly reflected the Covid-19 restrictions, and customers and employees were quick to respond to the latest changes. Customers were encouraged to book appointments if they wanted to visit their local branch, which enabled us to abide by the rules without sacrificing the level of service to customers. Customers were also given the option of having video meetings with our employees.

Customers were encouraged to continue to use digital service channels. The creation and development of digital service channels in recent years has proven absolutely invaluable during the pandemic, as the diversity of available digital financial solutions has been one of the Bank’s mainstays during this period. It’s gratifying to see an ever-growing number of customers using online banking or the app to take care of their business needs.

Our employees tackled a wide range of tasks and complex challenges during the year, and we made a point of looking after our people, ensuring their safety and well-being. A new policy on working from home offers added flexibility, and a large number of employers worked from home for some part of the year. Video meetings were held to share necessary information and to ensure effective teamwork. Working from home has continued to bring our teams from inside and outside the Reykjavík area closer together as they are in more frequent contact via video meetings and other media. Events and training and education for employees and customers were mainly in digital format this year with great results.

At Arion Bank we look ahead full of optimism, and we intend to build on the experience gained during the pandemic to continue to provide first class service anywhere, anytime.

Responsible lending and investment

Arion Bank is a signatory to the United Nations Principles for Responsible Banking (PRB). The goal of these principles is to align banking with international goals and commitments such as the UN Sustainable Development Goals and the Paris Climate Agreement. In 2021 we continued to implement the principles into our business.

In order to better align ourselves with PRB and the goals of the Paris Climate Agreement we have adopted an ambitious new environment and climate policy and targets which are designed to support Arion Bank’s commitment to being leading by example in environment and climate issues. The policy was updated slightly in 2021 and the targets updated to bring them in line with our plans for the next few years. More information on the Bank’s environment and climate policy and targets can be seen here.

The Bank’s credit rules stipulate that environmental, social and governance factors must be considered when assessing loans. The Bank’s credit policy also places special emphasis on sustainability and increasing the percentage of green loans, and quantifiable targets have been set. The Bank issued its first comprehensive green financing framework during the year and issued two green bonds on the basis of the framework. Green deposits continued to grow in 2021, and there was a substantial increase in loans to buy vehicles which run on 100% renewables.

Further information on green finance at Arion Bank

Arion Bank and its subsidiary Stefnir had ISK 1,352 billion in assets under management at the end of 2021. With respect to asset management, Arion Bank has introduced rules of procedure on responsible investment which incorporate the three basic criteria of sustainability: environmental, social and governance (ESG). The Bank is a signatory to the United Nations Principles for Responsible Investment (PRI) and has published progress reports since 2019. This means that not only financial criteria, but also other relevant criteria, are taken into account when analyzing investments and developing clients’ asset portfolios. See the section on Responsible Investment on the Bank’s website and the section on Markets for more details.

Responsible buying

The Bank's strategy is to create future value for the benefit of its customers, shareholders and society as a whole, and in keeping with this the Bank seeks to source its supplies from local providers as far as possible, provided they meet the requirements on quality and price.

Nearly all of the Bank’s key suppliers operate in Iceland. Although the supply chain does extend overseas, the first link is usually here on the domestic market. In fact there is only one international supplier in the top 10 main suppliers and only 9 in the top 50. The majority of the Bank’s international suppliers are connected to the buying of software, advisory services and IT services. Hardware is almost entirely acquired from Icelandic suppliers.

Buying is divided between the 50 main suppliers as follows:

The Bank’s environment and climate policy requires our suppliers to take into account the environmental and climate impact of their activities. Furthermore, when comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision.

The new buying rules approved in the autumn of 2020 took this into account, and a new supplier assessment was introduced in which suppliers are appraised on their performance in terms of environmental and climate issues, as well as equality and labour laws. In 2020 all the Bank’s main suppliers with whom the Bank has made outsourcing agreements underwent the suppliers’ assessment. The suppliers’ assessment is conducted on suppliers above a certain size and by the end of 2021, 23% of them had been assessed. During the year 70% of new suppliers who come under this definition and have an agreement with the Bank have undergone the assessment.

The Bank regularly assesses the performance of suppliers with which it has long-term business relationships, and all the largest suppliers with whom the Bank has made outsourcing agreements underwent the assessment in 2021.

A code of conduct for suppliers, which focuses on sustainability and social responsibility, was introduced in 2021. The code forms part of new buying agreements or is an appendix to existing agreements.

Donations to political activities

In 2021 Arion Bank adopted a special policy on donations to political activities. The policy states that the Bank provides grants to political organizations which put up candidates nationally in general elections and submit an application for financial support from the Bank. To be eligible for a grant the organization must have a member of parliament.

Arion Bank’s policy on donations to political activities

Information on donations to political activities in 2021 can be found in GRI index.

Responsible product management, product range and one-to-one marketing

In 2021 rules of procedure were introduced on responsible product management, where the emphasis is on protecting customers’ interests when developing the Bank’s products and ensuring that customers receive goods and services which are suitable for them. The procedure for responsible product management is clearly defined at Arion Bank and takes into account the European Banking Authority’s Guidelines on product oversight and governance arrangements for retail banking products.

The Bank also adopted a policy on responsible product management, product range and one-to-one marketing during the year. The policy states that the Bank endeavours to offer goods and services which are beneficial to our customers, shareholders and society as a whole.

Arion Bank’s policy on responsible product management, product range and one-to-one marketing

Our commitment to sustainability

UNEP FI and Principles for Responsible Banking - PRB

In July 2019 Arion Bank became a signatory to UNEP FI, United Nations Environment Programme Finance Initiative which is a partnership between United Nations Environment and financial institutions across the world working to understand today’s environmental, social and governance challenges.

In September 2019, Arion Bank became a signatory to the Principles for Responsible Banking (PRI) which were devised by UNEP FI and 30 international banks. For further information on Arion Bank’s involvement with the principles see here.

Here is an overview of the Bank’s progress in implementing the principles.

Forum for climate issues and green solutions – Green by Iceland

In September 2019 Arion Bank became one of the founding members of a joint business and government forum on climate issues and green solutions called Green by Iceland. The role of Green by Iceland is to strengthen the partnership between the business sector and the government in order to reduce greenhouse gas emissions and to bring about carbon neutrality by 2040. The forum will also work with Icelandic companies to market green solutions internationally and to underpin Iceland's reputation as a global sustainability leader.

At the beginning of 2020 the Bank signed up for the challenge Hreinn, 2 og 3! organized by Green by Iceland, where companies are encouraged to make the transition to 100% renewable energy for their vehicles. Under this initiative, the use of new corporate cars powered by fossil fuels will be discontinued by 2023. This will make Iceland a global leader in the use of environmentally friendly fuels. This is in line with the targets set out in our environment and climate policy which states that no new vehicles will be bought from 2023 unless they run on 100% renewable energy.

United Nations Principles for Responsible Investment – UN PRI

In 2017 the Bank became a signatory to the United Nations Principles for Responsible Investment (UN PRI). The principles are designed to help investors understand the effect of environmental, social and governance (ESG) issues on investment and thereby encourage signatories to the principles to take non-financial factors into account when making investment decisions. A progress report on responsible investment is published annually by the Bank’s Asset Management division. For more information on responsible investments see the Markets section.

UN Global Compact – the UN’s initiative on sustainability

Arion Bank has been a signatory to the UN Global Compact, the UN’s initiative on sustainability, since 2016 and we submit a progress report to Global Compact every year. The compact sets out 10 principles on human rights, the labour market, the environment and anti-corruption.

IcelandSIF - Iceland Sustainable Investment Forum

Arion Bank has long been an active participant in the shaping and development of responsible investment in Iceland and was one of the founding members of IcelandSIF, the Iceland Sustainable Investment Forum, in 2017. Over the years the Bank has had representatives in the board and working groups for the organization. The chairwoman of IcelandSIF is Kristbjörg M. Kristinsdóttir, CFO of Stefnir, a subsidiary of Arion Bank.

Excellence in corporate governance

Arion Bank has been recognized as a company which has achieved excellence in corporate governance following a formal assessment based on guidelines on corporate governance issued by the Icelandic Chamber of Commerce, the Confederation of Icelandic Employers, and Nasdaq Iceland. Arion Bank was first recognized for excellence in corporate governance in 2016. This recognition is given following a comprehensive audit by an independent party of corporate governance at the Bank, such as governance by the Board of Directors, sub-committees and management. It applies for three years. For further information see the sections on Corporate Governance at Arion Bank and on Non-financial Information.

Festa – Center for Sustainability

Arion Bank has been an active partner of Festa – Center for Sustainability, for several years. Festa’s role is to add to the expertise on social responsibility and sustainability at companies, institutions and organizations.

At the beginning of 2022 the Bank as one of the main sponsors of Festa’s January conference. The theme of the conference was sustainability and future plans and included presentations by some of the leading academics and leaders globally in the field of sustainability and climate issues. The conference was held online and was open to anyone who wished to participate.

City of Reykjavík and Festa’s Declaration on Climate Change

In 2015 Arion Bank became one of 104 signatories to the City of Reykjavík and Festa’s Declaration on Climate Change. One of the main tasks concerning climate change is to map the environmental impact of operations and to systematically reduce the negative effects. We have published the Bank’s environmental accounts annually since 2016. Further information on environment and climate issues at Arion Bank can be found here and the section on Non-financial Information.

Declaration of intent on investment for a sustainable recovery

On 25 September 2020 Arion Bank signed a declaration of intent on investment for a sustainable recovery. The Prime Minister’s Office, Festa – Center for Sustainability, the Icelandic Financial Services Association (SFF) and the National Association of Pension Funds (LL) devised the declaration in close cooperation with representatives of the main participants in the financial market. The declaration of intent conforms to Arion Bank’s policy and goals on greater sustainability.

Ministry of Welfare’s equal pay symbol,

In the autumn of 2018 Arion Bank was awarded the Ministry of Welfare’s equal pay symbol after having been certified by the standards agency BSI á Íslandi, the first Icelandic bank to gain this recognition. The Bank first gained equal pay certification in 2015 and has since undergone a pay assessment annually. For further information on equal opportunities see the section on Human Resources and on Non-financial information.

UN Women and UN Global Compact

The Bank has supported the UN Women/UN Global Compact Empowerment Principles since 2014. These are international declarations and treaties under the auspices of the United Nations which companies and institutions can use as guidelines when implementing responsible working practices, irrespective of geographic location or sector and primarily concern advancing gender equality. For further information see the sections on Equality at Arion Bank and on Non-financial Information.

FKA Equality Scale

In 2020 CEO Benedikt Gíslason signed a declaration of intent on the Equality Scale, stating that over the next few years Arion Bank intends to systematically work towards achieving an equal gender ratio at senior management level. The Equality Scale is an initiative created by the Association of Icelandic Businesswomen (FKA).

The Bank was first recognized by the Equality Scale for achieving an equal gender ratio at the top level of management in 2020 and achieved the distinction for the second time in 2021. See here for further information.

Kolviður – Iceland Carbon Fund

The Iceland Carbon Fund has been responsible for offsetting the carbon emissions produced by the Bank's activities since 2019. The Iceland Carbon Fund will continue to fix the carbon in plants and soil through soil reclamation and forestry to offset the carbon emissions resulting from the Bank's activities in 2021. The Iceland Carbon Fund is expected to plant up to 5,000 trees for the operating year 2021. This refers to emissions produced, for example, by vehicles used in the Bank's operations, its business premises, waste, business flights and journeys to work. It does not involve verified carbon units.

Nasdaq ESG reporting guide

The ESG Reporting Guide for the Nasdaq Nordic exchanges provides guidance on data disclosure and the environmental, social and governance impact of listed companies. Since 2016 Arion Bank has used these criteria when reporting on sustainability. The criteria formally came into effect in 2017 and a second edition of the reporting guide came out in 2019. For more information on ESG reporting see the section on Non-financial information.

PCAF – Partnership for Carbon Accounting Financials

In November 2021 Arion Bank became a signatory to the Partnership for Carbon Accounting Financials (PCAF). It is a global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments. Arion Bank will apply this methodology in 2022 to estimate the carbon footprint of its loan portfolio.

Further information on the Bank’s involvement with PCAF can be found here.

CDP

Since 2019 Arion Bank has disclosed its climate impact via CDP, a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts. More than 13,000 companies published their environmental data via CDP in 2021. Further information on CDP can be found here.

TCFD

In order to gain a better overview of the risk related to climate change the Bank has made use of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The section on sustainability risk in the Bank’s 2021 Pillar 3 Risk Disclosures is partly based on these guidelines and it also contains an analysis of the Bank’s loan portfolio from the point of view of climate risk. The Bank formally became a signatory to TCFD in February 2022. For more information refer to the Pillar 3 Risk Disclosures for 2021.

Innovation and support for entrepreneurs

Innovation is integral to our business and improves the Bank’s ability to compete in the long term. Continuous and focused scrutiny of whether the current methodology applied to goods, services and processes is optimal for success is one of the keys to our operations.

.jpg)

In recent years the Bank has collaborated on a wide range of exciting investment projects with our customers with the aim of strengthening the business sector in this country. This is particularly true of the intellectual property industry, a flourishing sector in Iceland and a vital source of future value creation. We are committed to supporting innovators and we nurture innovation and growth through partnerships with selected partners.

Arion Bank’s commitment to innovation and active participation in the development of a creative economy supports two of the UN’s sustainable development goals. These are goal number 8, decent work and economic growth, and goal number 9, industry, innovation and infrastructure.

Arion Bank has invested directly and indirectly in numerous start-ups and participated in events related to innovation. In 2021 Arion Bank was one of the partners of Iceland Innovation Week, which organized a hackathon, among other events.

Strategic partners

.png)

Enhanced service to people on the rental market through Leiguskjól

Leiguskjól is an excellent example of a partner selected by the Bank to support the services offered by the Bank. Leiguskjól participated in Startup Reykjavík in 2018, and the Bank invested in the company, acquiring a 6% interest. In 2019 the Bank entered into a partnership agreement with the company and increased its investment to 51%. The investment and partnership agreement with Leiguskjól clearly demonstrates the Bank’s commitment to stepping up its collaboration with fintech companies, where the aim is to utilize the Bank’s core strengths and to combine it with the focus and dynamism inherent in innovation.

Eyrir Sprotar – investing in startups

Arion Bank, in cooperation with Eyrir Invest, runs the venture capital fund Eyrir Sprotar slhf. Eyrir Invest and Arion Bank are the fund's largest shareholders. The fund is worth ISK 6 billion and has invested in 11 companies.

Advancing innovation on the financial market with the Fintech Custer

Arion Bank is a member of the Fintech Cluster, an organization designed to advance innovation in the financial sector. The Fintech Cluster also runs an innovation centre and organizes a range of events.

Supporting young entrepreneurs

The Bank is one of the main sponsors of Junior Achievement Iceland. The role of this organization is to prepare young people for the future and to improve their skills for the job market and by promoting education in innovation, entrepreneurship and business at secondary school level. In 2021 it organized a competition for secondary school students which gave students the chance to experience innovation first-hand in the classroom. A total of 126 companies were set up in the competition and 30 went through to the final. The company Hrauney, owned by six students from the Commercial College of Iceland, was named company of the year and represented Iceland at the JA Europe Company of the Year Competition held in Lithuania.

.jpg)

Supporting the community

Arion Bank organizes a wide range of informative lectures, conferences and events and is an active member of the community. Numerous people attended lectures, conferences and other events organized by the Bank in 2021. Arion Bank also participated in many conferences and exhibitions elsewhere. However, the restrictions on mass gatherings meant that the Bank hosted far fewer events during the year than normal.

Events held in 2021 included:

- Around 450 people watched the Bank present its economic forecast, which was also streamed live on the Bank’s Facebook page.

- Many customers and other guests watched live streams of informative meetings on pensions savings.

- High school students visited the Bank and learned about investment. Arion Bank also visited senior high schools and held talks on financial literacy.

- Many events were streamed live from the Bank, including the IPOs of Play and Solid Clouds, and press conferences by the Icelandic Handball Association.

Giving back to the community

Arion Bank collaborates with numerous organizations and companies and supports a wide range of good causes in the community.

- Arion Bank was one of the main sponsors of the Arctic Circle conference held at Harpa Concert Hall in October. The aim of the conference was to promote discussion and collaboration on the future and development of the Arctic, a region whose importance is set to increase in the coming decades, not least because of climate change. The conference was attended by influential people from the worlds of politics, economics, academia and NGOs.

- Arion Bank is one of the main sponsors of the Icelandic Handball Association and has been providing backing for the sport in Iceland for many years.

- The Bank was one of the sponsors of the National Olympic and Sports Association in 2021 with the goal of promoting sport in Iceland and participation in international events by Icelandic competitors.

- Arion Bank is one of the main sponsors of the Icelandic Sports Association for the Disabled and is helping athletes prepare for competitions in 2022.

- Arion Bank supported the Association of Icelandic Businesswomen in 2021, for example hosting their event Visibility Day.

- Arion Bank sponsored the NKG Innovation Competition, a competition designed to boost innovation in primary and secondary schools.

- The Bank supported a number of charities including the Icelandic Cancer Society.

- Arion Bank supports the Icelandic Forestry Association, helping to fund an initiative to further advance public knowledge of forests, and to provide information and improve access to forests for recreational purposes. The Bank also provides funding for planting trees.

- Arion Bank is sponsoring the Dean’s List at Reykjavík University and signed a partnership agreement with RU in November 2020. The Dean’s List is reserved for students who achieve the best results in each semester. The aim of the list is to inspire students who gain outstanding academic results and to highlight their achievements. Students on the RU Dean’s List have their tuition fees for the next semester waived.

- In addition the branches support diverse causes in their local areas.

Sustainability news

.png)

%20(1).png)

.png)

%20(1).png)

.png)

.png)

.jpg)